Common Misconceptions about Digital Payments

December 24, 2024

In recent years, fueled by the rising adoption rates of smart devices, digital payments have been growing across the globe. While the speed of growth is led by developed regions, developing areas boast a growth driven by youth, from 35% to 57% between 2014 and 2021. Although device adoption rates have stagnated in more developed countries, with increasingly new and innovative payment methods, the digital payment market is predicted to surpass $23.81 trillion by 2031.

Despite the popularity and accessibility, digital payments often take away the physical attachment between a user and a card or bill notes. Because of this, users are often concerned about platform security, user data collection, processing, and storage. In this article, we're touching upon the common misconceptions that end-users have over digital payments and what relative payment service providers can do to enhance customer trust.

1. Payment applications and websites are risky

This is exceptionally true for applications and websites where users cannot clearly identify the service provider and whether they are operating legally.

Payment applications and websites, if developed in accordance with the regulated security standards, protocols and used under careful credential management, are generally safe. However, it's important for users to understand that the risks of online payment fraud and identity theft extend beyond the platforms themselves. This includes how users are using the applications and websites, their devices, and how they are handling their personal data and account details over time.

-

HiTRUST Tip: When operating payment applications and sites, make sure your licenses are up-to-date, ensuring strict compliance to the regulations in your business region.

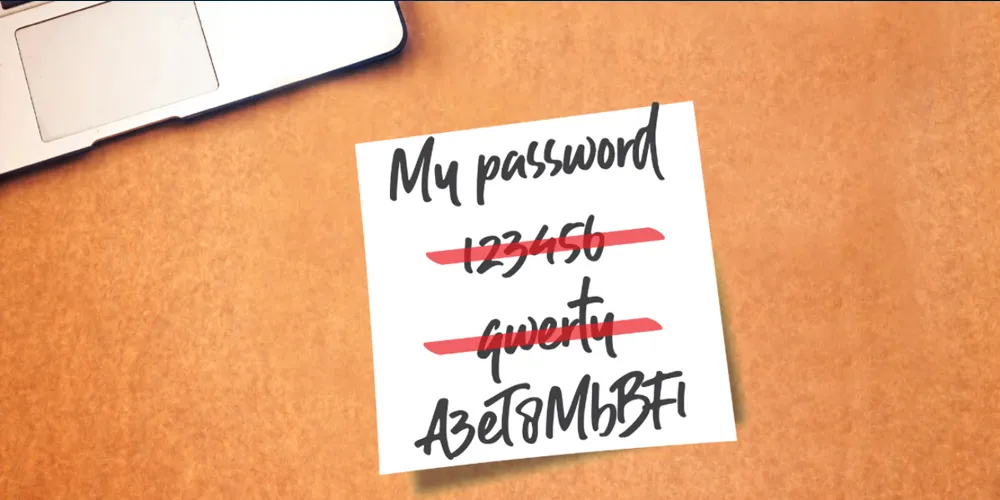

2. A strong password is enough to secure accounts and transactions

In contrast with this belief, a strong password is only stronger than a weak password. Experts at leading technology companies such as Microsoft have suggested that a 15-character password consisting of letters, numbers, and special symbols arranged randomly would make a significantly strong password. In reality, an average person has around 100 online accounts for different purposes, and setting up 15-character combinations for each isn't all that ideal.

Passwords, in general, are prone to be stolen and leaked because users tend to reuse them across different websites and platforms. Once the data of a website or platform gets stolen, hackers can use those breached credentials to attack the others, creating a domino effect.

-

HiTRUST Tip: To better manage website and platform member access, opt for multi-factor authentication, or passwordless options such as Passkeys to strengthen the system, eliminate the need for users to remember them and businesses to manage them. See more about Passkeys here.

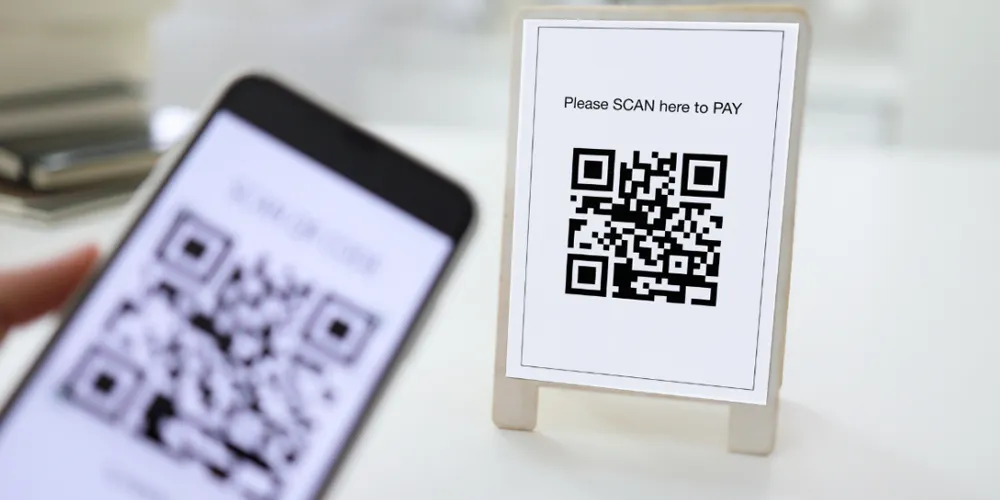

3. Contactless payment can be easily intercepted

With great payment innovations, the contactless method is being offered at many merchants around the world. Supported by NFC or code-scanning technologies, this method allows cardholders to use their smartphones instead of physically presenting their credit cards at the point of sales (POS).

Despite being a convenient method, contactless payment cannot be intercepted that easily since both the POS device and the user device must be not more than a few inches apart for it to happen.

-

HiTRUST Tip: If you offer contactless payment at your physical POS or online on your website/ platform, remind your customers to thoroughly check the payment details before confirming and only initiate contactless payment when they are ready to pay to avoid unwanted charges.

4. Digital wallets are less secure than banking accounts

Digital wallets generally work to store and process sensitive, user-related information such as bank account, credit card details, etc., and they are required to comply with necessary security standards, depending on the operating region. While these security standards generally include KYC (know your customer), AML (anti-money laundering), and PCI DSS, they could extend to include SCA (strong customer authentication) or online fraud detection, depending on the regulating country.

With many regulations to follow, when operated by legitimate providers, wallets are generally secure for use and can be comparable to banking accounts. On another note, in Asia, many digital wallets are actually co-branded by banks and fintech companies.

-

HiTRUST Tip: If you're operating as a digital wallet, equip your card-binding procedure with 3-D Secure authentication to safely confirm the user's credit card ownership. This adds another layer to payment activities on your platform, especially when you store card tokens. Another way to ensure payment security is through understanding the risks behind each transaction. Additionally, always ensure that your data storage system is safely secure to avoid breaches that would lead to account takeovers which may or may not directly occur on your platform.

5. Digital transactions cost more

Banking and payment service in general charge customers at different rates, depending on the provider, the market, the complexity of service and more. When compared to cash payments, digital transactions must incur some cost on the service provider's side. However, in many countries, cashless services are of significantly less cost due to the active efforts from the government and payment companies to promote the cashless society movement.

A great example for cost-effective cashless services is the QR-code method present in some Asian countries such as Thailand, Vietnam, Indonesia, China, South Korea, and more.

-

HiTRUST Tip: If you're looking to promote cashless payments, aim to incentivize your customers with rewarding loyalty programs, exciting discounts and offers. Promotions of online payment services have always been targeted at younger user groups, you can also encourage older groups of customers with simple and easy payment flows to remind them that cashless payment is for everyone!

Conclusion

When it comes to payment, one of the biggest concerns for customers is security. Apart from developing a great platform to deliver exceptional services, we must not forget to ensure utmost security on both our end and the users'.

If you're looking for a safe way to log your users in, without putting their credentials at risk of breach, safely go passwordless with us today! For a more in-depth look into users’ risk in each and every transaction, check out our Fraud Detection System, powered by AI algorithms to safeguard your payments end-to-end.